Welcome TPT sellers and/or fellow tax-confused friends! It was income tax reality day for my little business today so I'm here to tell you a little bit about it before I forget it all! (That happens often these days!) It's a little LONG, but hopefully will give you some good information!

A few years back, when I was new to selling, I searched everywhere for tax advice without a whole lot of success. I was SUPER confused because I had not received any income statement from Teachers Pay Teachers and was attempting to do my own taxes. It was a nightmare. Notice this blog post title? It is very simple and to the point for a reason. When I was searching for more info related to a HOME OFFICE with my own taxes this year, I Googled these key words but I did not find much else to help me with tax info for small business owners like myself. Some of what I have to share with you are things I learned from doing some research over the years. I also found out some surprising NEW TIDBITS of information today during my own tax session so I want to share these with you too. Please be advised that I am NOT a tax expert by any means so when in doubt, ask a professional! Like most things I blog about, I am only writing from my personal experiences! :)

It didn't take too long to get my ducks in a row for tax season because I know what to anticipate and what to save. So many websites allow you to easily print summary statements for the whole year and that is exactly what I do.

You may be wondering what business write-offs there are for sellers. It's pretty simple really. What I have been told is that anything that is directly related to your business like ink, graphics purchases, font licenses, TPT annual fees, expenses for marketing your items, blog designs and all of that are deductible expenses. Some other things may be questionable... like deducting your phone if you only have a cell phone as a home phone. There are gray areas for everything of course.

All of my paperwork was organized nicely as I lugged it all with me to the appointment in my snazzy tax tub. As ready as I thought I was, I did not plan for everything. I also know that it is not necessary to drag every piece of paper along but I do just in case. Here's what she asked to see for both personal and business taxes:

- W2

- the tax return from the previous year

- totals for itemization such as union dues

- charitable donations amount to church, Goodwill, etc. (estimated value at 50 dollars per bag of clothing)

- totals for business expenses by category (supplies, marketing, tools, and depreciable items like furniture, cameras, technology, software...)

- mortgage interest

- banking interest

- home tax info

- total for earned income (business)

- total amount only for utility expenses (gas, internet, electric, phone...) not every receipt needed

- investment info

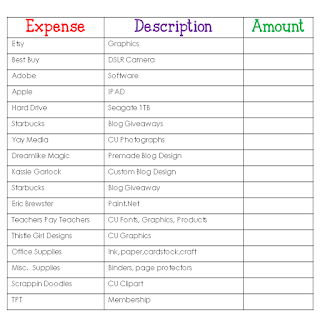

I made myself a chart for our appointment which was helpful, but I did NOT need to list TPT, Etsy, ThistleGirl Graphics and all of that separately. They all fit under tools for my tax purposes.

It looks something like this only the finished list was MANY more pages!

I will edit it for next year to include broader categories and totals for supplies, advertising, tools, utilities and so on.

Though I have learned I can travel light, you bet I am saving every piece of documentation, and all receipts, in my files at home!

Here's what I needed to provide that I did not have ready on the chart...

- square footage of the room I use as home office (must be exclusively used for that purpose)

- estimated percentage of use of the internet service as I am not the only person living in the household

- percent of usage for the cell phone- related to business use

- total expenses for any home repairs- inside or outside done in the last year ( I really wish I had known this because I spent way more than what I reported today and remembered only after I got home)

- amount spent on exterior maintenance of the home (landscaping, snow removal...)

There are probably a few others that will come to me later! Claiming a home office and all of its related expenses is a bit of a tax break but HERE'S THE KICKER! I am planning to move in the near future. Now that I have claimed a home office on taxes, I will be required to pay an additional tax on that home office when I sell my house...interesting. Still it was wiser to claim it than not to.

Of course. this post can't possibly be all-inclusive. If there is something I forgot to mention or if you have any other suggestions for more items to add to claiming a home office specifically, please feel free to leave a note in the comments section below!

Every seller's situation will be different than mine, but hopefully you have a better starting point or have gotten a few new tips along the way here today! The best advice is to be as detailed and precise with your business as you are with every resource you create. At tax time, you will be glad you did! Saving all of your business paperwork and receipts in a file, binder or tub is very helpful. Knowing what you can or cannot deduct and bringing the proper documentation with you is important so you can have a quick and hopefully painless meeting with your tax preparer or accountant.

All in all, there was not too much damage to the pocketbook today. I did OWE a little this year, despite taking advantage of every possible available deduction! I'm glad I always plan ahead and keep money aside for taxes on my extra income.

Now that you have some good information to guide you as a TPT seller, you may also want to get a cute tax tub going like I did.

:)

I love your post! I am always confused and TRY to stay as organized as possible! Thank you for sharing your experience and wisdom! -Jaime

ReplyDeleteThanks for the information. I am trying to come up with a way to stay organized for next year but have not figured it out yet. I have a question that maybe you can answer for me. I have stores on TPT, Teachers Notebook, and Educents...does that make a difference on taxes or is it all considered one business?

ReplyDeleteHi Michelle! I know it gets very complicated in this digital marketplace as it is not the typical business. YOU and your items are the business entity, not the storefront, is what I have been told but don't quote me on that! To avoid any further confusion, I recently changed all of my store names to the same title. If you find out more come back and let us know! :)

ReplyDelete